This is also a very important section and you need to fill in data here before start using the application.

Here you need to set GST Percentage and HSN for all your products of your Shopify Store.

For this we have given you two options, You can use anyone which suits your need.

The first one is going by-product method and the second is going by Collection method.

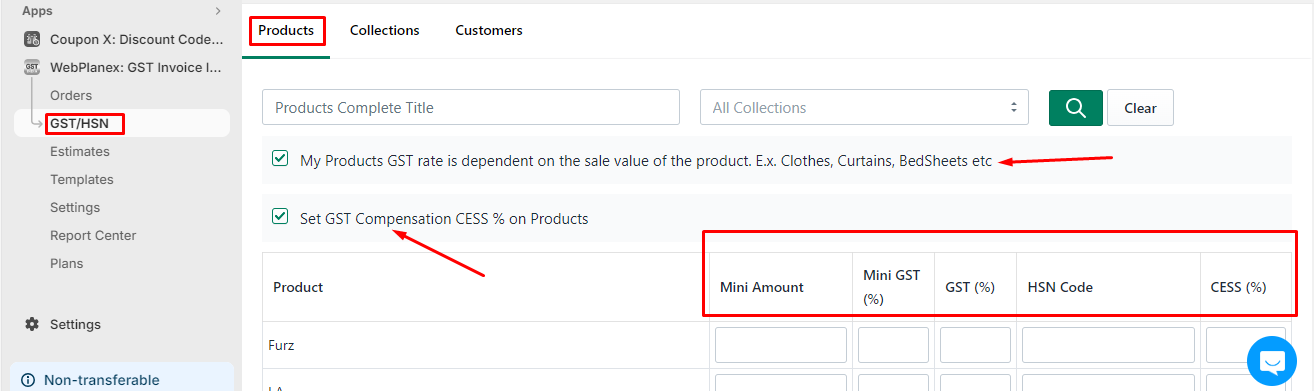

Lets see how you can set GST% and HSN by Product

See Point 1, Tick this box if your Tax depends on Product Price, if you have single GST% irrespective of the price of the product do not tick this box.

When you tick the first checkbox shown in Point 1 of the image some new options will come in front of you beside each product.

Mini Amount >> This means the cutoff price of the product where the system needs to decided GST % to charge.

Mini GST% >> GST% will be charged on product based on data entered here where the price of the product is less than entered on Mini Amount.

GST% >> GST% will be charged on product based on data entered here where the price of the product is greater than entered on Mini Amount.

I know this confused you a lot, so let's take an example.

See, suppose if you are selling one T-Shirt where you need to charge 5% tax for a price below 2500 and 18% if the price is greater than 2500. So, in this case, you need to add details like.

Mini Amount == 2500 || Mini GST (%) == 5% || GST (%) == 18%

Point 2 If Tax on your product does not depend on the Price of the product, do not tick the box shown in point 1

If you want to add CESS on products then only tick "GST Compensation CESS %".

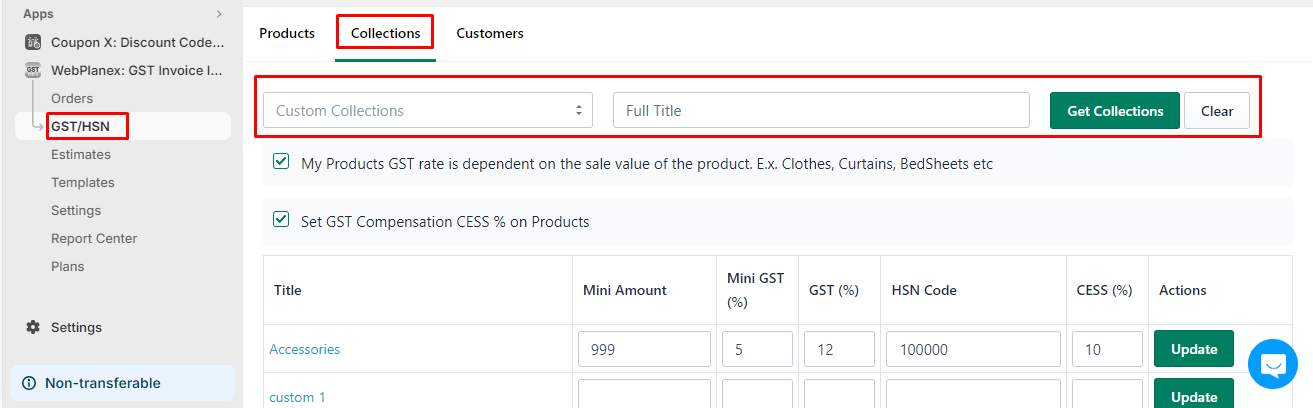

Now, lets see how you can set GST% and HSN by Collection

Here as you see in the above image, you can filter your collection by Smart Collection or Collection based on how you created the collection at the Shopify level. Rest all instructions are the same.

Note

1. You need to set GST% for all products in your store. HSN settings are also advisable but not mandatory.

2. To narrow down results you can use filters on-page or search with the EXACT Product name and you can narrow down to product. Make sure you need to search FULL product name as Shopify API for search will only work with full product name.

3. If you set GST% by Collection and if you have more than 250 products in the collection, please contact us on live chat as due to Shopify limitation by the automated system we can not set GST% in all your products in that collection, we need to manually do this for the very first time.

4. When you add a new product to the store you need to come here and set GST% for that product. If you have set GST% by collection method then you need to click the UPDATE button besides that collection name in order to set GST% and HSN for that newly added product.

5. For new store joining GST Invoice India we will pull your Past 7 days invoice free but it will be shown based on the plan you have. To get this pull done you need to contact on live chat.

So, now your GST bills are automated and everything will be decided by the system i.e. when a new order comes, the system will decide CGST/SGST or IGST based on store location and customer address and create bills for you.