If you have multiple warehouse locations across India and fulfilling orders from the nearest location state then you can set all your location addresses in Invoice settings and based on order fulfillment location it will show the address of the warehouse and accordingly, CGST/SGST or IGST will be decided.

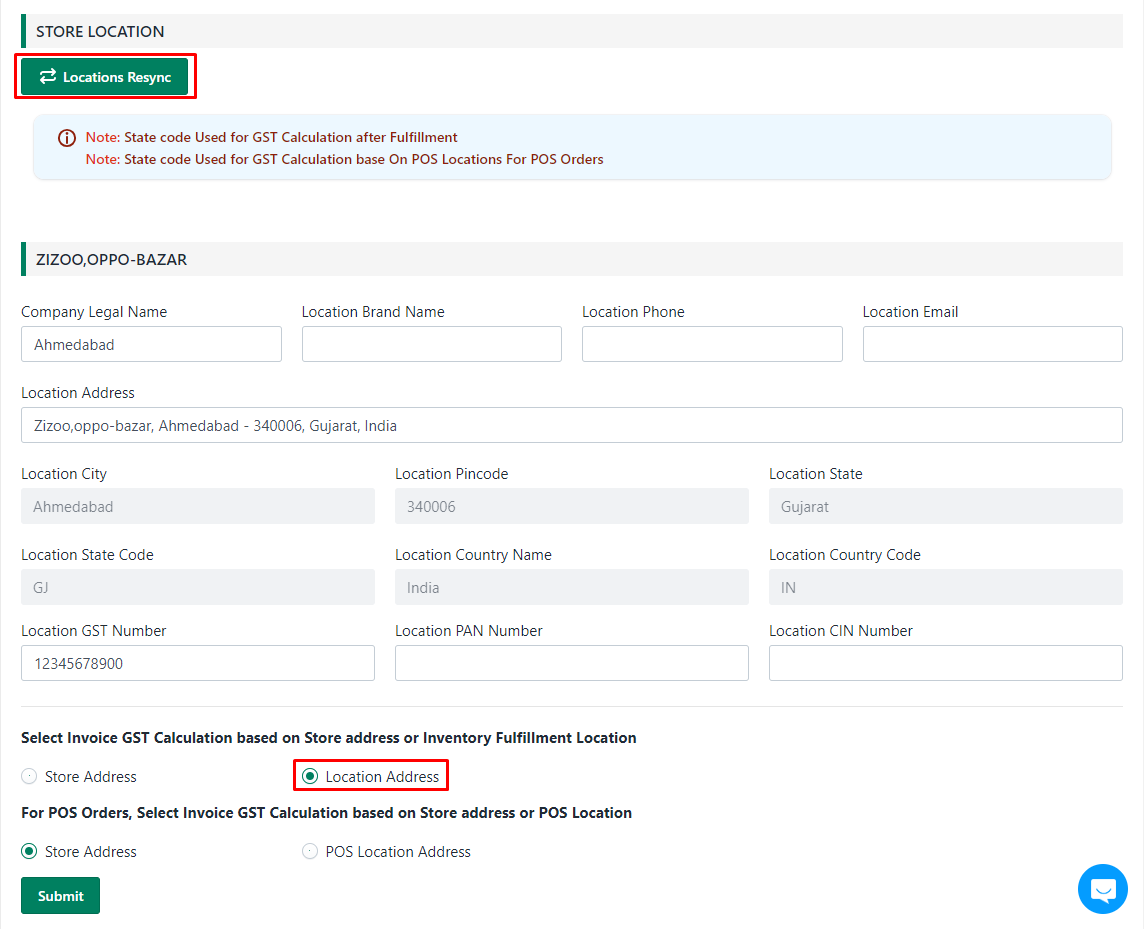

To do this go to Invoice Setting and locate “Locations” if your Shopify store location is missing click on ReSync blue button. Once Location appears and if you want to calculate GST based on Supply state and destination state then make sure you keep “Location Address” enable under “Select to Set Address in Invoice header and Use State for GST Calculation after Fulfillment”.

For example, the Customer billing state is Karnataka and Store has two warehouses one in Karnataka and one in Tamilnadu and you are fulfilling orders from the Karnataka warehouse then it will show CGST/SGST on the invoice. If Location Address is enabled and order is fulfilled from that location.