You can set tax rates for your store on the Settings → Taxes page in your Shopify admin.

If you do not see India in the list of countries in the Tax rates list, you will need to add it as a shipping zone first.

- If you do not see India in the Tax rates list, go to Settings → Shipping→ Shipping profiles and click Create new profile.

- Click Create Shipping zone and select India.

Once you have India included in the Tax rates list, you can set up the individual tax rates of each state.

To set up tax rates for India:

- Go to Settings → Taxes in your Shopify admin and click on India.

- Enter the 9% CGST tax rate into the Country Tax field.

- For the state your store is based in, add the SGST (or UTGST) rate and choose added to 9% federal tax from the drop-down.

- For all other states, add the IGST rate and choose instead of 9% federal tax from the drop-down.

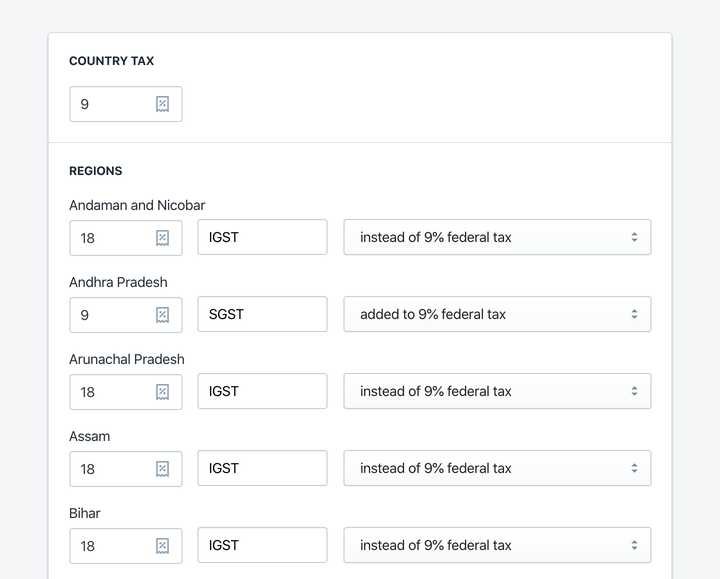

An example of tax settings for a Shopify store based in Andhra Pradesh.

Different tax rates

If you sell products that are taxed at different tax rates (slabs), you will need to add tax overrides.

To set up tax overrides in Shopify:

- Go to Settings → Taxes in your Shopify admin and click India.

- Scroll down to Tax overrides.

- Add a collection of products from your store that should be taxed differently and set their Tax Ratesfor both India and individual states.

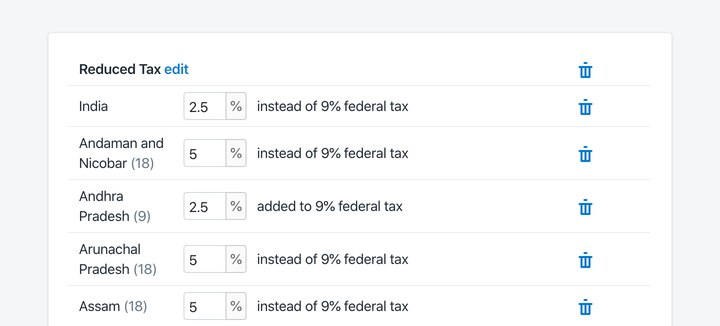

An example of tax overrides for a Shopify store based in Andhra Pradesh.