Step 1: Export the CSV File

Begin by exporting a CSV file that contains the collection data from your store. This file will be your working template for updating or entering information related to each collection, including HSN codes and GST percentages. Before exporting, make sure these fields are correctly set for all the collections you plan to work with. Accuracy at this stage is critical to ensure the rest of the process goes smoothly.

Step 2: Fill and Validate

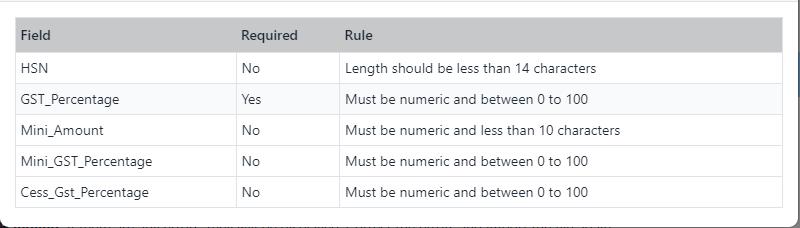

After exporting the CSV file, fill in the required details for each collection. This includes ensuring that the HSN codes and GST percentages are correctly entered. Once you've completed filling out the file, it's important to validate the data against the validation rules stated in below table. Validation checks for any errors or discrepancies that might prevent the file from being imported correctly, helping you catch potential issues early.

Step 3: Import the CSV File

With the CSV file filled and validated, the next step is to import it back into your system. During this process, the system will analyze the data and, if any errors are detected, they will be displayed for your review. This initial import serves as a test run to ensure all information is formatted correctly and adheres to the required standards.

Step 4: Error Handling

If any errors are identified during the import, the system will notify you. These errors could be related to incorrect formatting of HSN codes, or invalid GST percentages. You'll need to correct these errors in the CSV file and then re-import the file. This step ensures that only valid, accurate data is uploaded.

Step 5: Successful Import

If no errors are detected, the system will proceed with importing the collection data. Depending on the size of the file and the number of collections, this process may take some time. Be patient and allow the system to complete the import. Once the process is finished, your collections, including their HSN and GST % details, will be successfully updated the WebPlanex:GST Invoice App.

Collection CSV File Validation Rules: